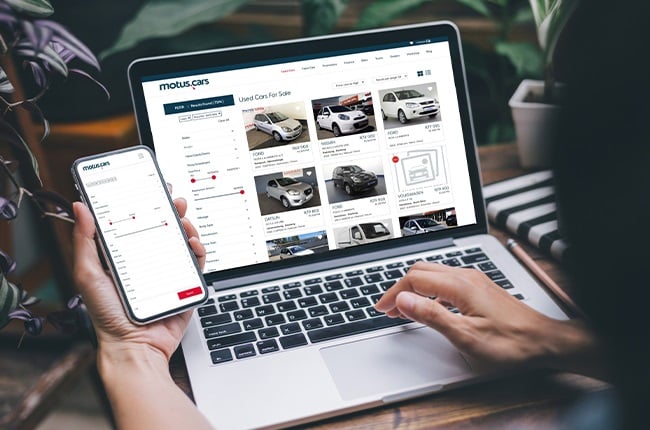

Five tips to increase your chances when applying for a car loan

• New car buyers are encouraged to come prepared when applying for finance.

• These simple steps can go a long way in ensuring your application’s success.

• Between half and two-thirds of your budget should be allocated to the vehicle’s instalment.

With increased living costs and the stresses of everyday life in lockdown in the current economic climate, many consumers are fearful of being turned down when applying for credit. Whether it’s a house, credit card or a new vehicle, banks are bound by law, through the National Credit Act (NCA), to ensure that consumers can afford the financial commitments into which they enter.

While credit should never be used to live beyond one’s means, it can be a necessity – as in the case with financing a car, which is a significant financial commitment.

And while there’s no guarantee that a customer’s application will be approved, there are best practices to follow that can improve one’s credit health and significantly increase the chances of being granted credit.

1. Establish your affordability

The first step in calculating your budget is finding out how much you can afford to spend on a car. To do this, take your income (after taxes and deductions) and subtract all your monthly expenses such as food, rent, airtime, subscriptions, insurance and the like. All these costs need to be deducted from your total income to arrive at your disposable income. This is the money that can be used for luxuries, savings or essential credit, such as monthly car instalments.

Carrying out this budget exercise at home gives you a clear picture of how much you can spend on car instalments – you can also go online or download the user-friendly Bravo App and use the Bravo affordability calculator to help you. When you then submit your vehicle finance application online or at a dealership, you will already have this breakdown at hand for the bank to assess if you can indeed afford the loan repayments on your selected vehicle.

Establishing your affordability

2. These extras aren’t optional

Remember that affording a car isn’t just about settling the monthly instalment. If you have calculated that you have R5000 to spend on a vehicle after paying all other monthly expenses, you will need to use that amount to cover the instalment and other essentials. Fuel and comprehensive insurance cover are examples of ongoing monthly expenses that need to be budgeted for. If your vehicle doesn’t have a service or maintenance plan, you should also consider putting some money aside each month to cover regular maintenance costs.

These items form part of the overall cost of vehicle ownership and should be included in your budget when submitting your finance application. If your budget allows for these costs, you improve your chances of your application being approved for a car loan.

In general, Bravo advises allocating between half and two-thirds of your budget to the vehicle instalment, with the remainder allocated to the additional costs. For example, if you only have R5000 a month to spend on a car, between R2500 and R3000 should be used for the instalment repayment, with the remainder going towards fuel, insurance and maintenance costs.

Items such as fuel need to be budgeted for when buying a new car

3. Save up for a deposit

If you’ve demonstrated to the bank that you can budget responsibly, you’ll impress them further if you can put down a deposit payment. While it’s not necessary to pay a deposit, doing so will work in your favour in the long term. Paying a deposit reduces the amount of credit required for the transaction, which means lower monthly repayments, less interest and improved affordability. Your ability to afford the monthly repayments is one of the biggest drivers when banks assess your finance application.

Financial responsibility also reflects well on your credit profile, which will also go some way to ensuring your finance application will be approved.

Having a deposit for a new car can improve your application’s success rate

4. Settle as many debts as possible

Your credit profile or credit history shows banks how you use credit. This includes clothing accounts, overdrafts, home loans, personal loans and credit cards. As long as you make your monthly payments on these accounts, your credit profile will be spotless, and banks will view you as a reliable borrower.

According to the NCA, there are two main types of credit agreements. The first is a credit transaction such as a personal loan, which is taken out and paid off, with interest, over a certain period. With each payment, the outstanding balance reduces over the agreed loan period.

The second type of credit agreement is a credit facility such as an overdraft or a credit card. These are revolving facilities with a maximum amount but also require a monthly repayment of an agreed amount.

When applying for credit, the bank takes all your current and available credit into account. For example, if you have a personal loan that you have been paying off for two years, with a balance of R15 000 and instalments of R1000, these figures are used in assessing your affordability.

If you have credit facilities – such as a credit card with a limit of R50 000 and an overdraft with a limit of R25 000 – these amounts are also included in the assessment, whether they are fully used or have a zero balance. These facilities remain in place even after your vehicle finance has been approved, and if you do use them, your monthly affordability has to include their repayments. For this reason, the NCA requires the bank to take all credit facilities into account.

The best advice here is to have as little debt as possible, which frees up money in your monthly budget. Once you’ve paid off an account, it is a good idea to close it – or lower the total limit for the facility. The fewer credit facilities you have in your name, the better it looks for your credit profile and your future finance applications.

New vehicle buyers are encouraged to settle as many debts as possible

5. Trading in for the best deal in town

Once you’ve completed the budgeting exercise and calculated what you could afford in a vehicle, you’re ready to visit a reputable, approved dealership. One other thing to consider if you own a vehicle is trading in your existing car. If you’ve had your current car for more than four years, chances are that its trade-in value will be more than the money you still owe the bank. This means you’ve passed the break-even point for your vehicle loan. It also means that the money you make from trading in your car can be used as a deposit towards your new vehicle purchase. The same is true if your car is paid off: the money you receive from that trade-in deal can be put down as a substantial deposit on the cost of your new car.

If your vehicle’s trade-in value is less than the amount you owe the bank, it means you have not yet reached the trade-in value. In this scenario, you will either have to keep your existing vehicle for another couple of months, or you could use some of your savings to assist in settling the existing vehicle loan – though that is not ideal. Of course, having a trade-in where you don’t have to pay additional money is going to benefit your car loan application greatly.

The last thing to keep in mind is to be patient and shop around for the best deal. The new vehicle market is very competitive. With the current low-interest rates, manufacturers have some very attractive offers, which could help you afford a car and others that offer better value. Find a deal that suits your budget and your needs, and use the advice provided to assist you with your next finance application. If you’ve carefully considered your expenses, calculations and affordability range, your application for finance should be approved.

Lebogang Gaoaketse is the Head of Marketing and Communication at Bravo Finance

Lebogang Gaoaketse