Fixing your home loan rate: What you need to know

- Two of the five members of the monetary policy committee voted against a rate cut on Thursday.

- But the Reserve Bank predicts rates could start climbing in the second half of 2021.

- This may prompt mortgage holders to fix their rates – but, importantly, your bank will decide which fixed rate it is prepared to offer.

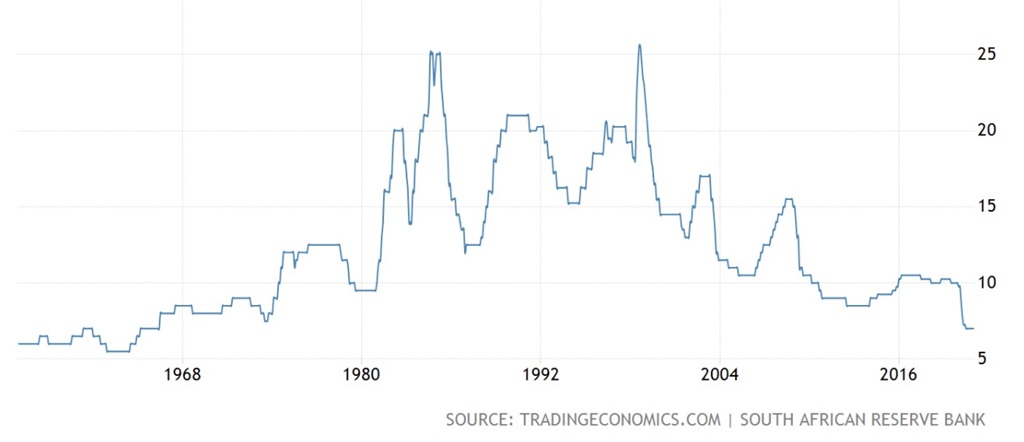

Last week, the Reserve Bank’s monetary policy committee kept the repo rate at 3.50%, leaving the prime rate at 7% – it has now been at the lowest rate in almost half a century since July last year.

On a new home loan of R2 million, this means your monthly payment is R3,500 less than a year ago, when the prime rate was closer to 10%. Prime climbed above 25% as recently as in the late-1990s.

Prime interest rate. Source: Trading Economics

With the Reserve Bank itself predicting that rates could start to climb again in the second half of this year – should you think about fixing your home loan rate?

You first have to confirm with your bank which fixed rate it will offer, and for how long, says Simon Brown, analyst and founder of the financial education platform Just One Lap. Typically, banks will fix a home-loan rate for a maximum of five years.

The fixed rate they will offer is usually higher than the current floating rate, he adds.

“Fixed rates offered by the bank vary on a regular basis, and depend on a number of factors, including the outlook of the bank on the future movement of interest rates. Customers, therefore, cannot choose which rate to fix at, but can ask to be quoted on the rates available at any given time, and select whether to fix at the offered rate then, or not,” says Bravo Finance’s head of home finance Mfundo Mabaso.

Also, the longer you want to fix the rate for, the higher the rate on offer will be.

“In an environment where rates are going lower and probably staying low for a long time, if you are going to fix a rate, you want it to be fixed at a really proper level, rather than something that is higher than the current rates,” Brown added.

But fixing your interest rate at 7% would probably be an attractive deal, says Brown.

The big benefit of a fixed rate mortgage is the certainty it brings, as this kind of payment is usually the biggest monthly cost in most households,” according to head of customer delight at Nedbank Home Loans Thozama Mochadibane.

The downside, however, according to Mochadibane, is that “locking yourself into a fixed rate for say three years, is that there is a chance that interest rates could remain low or fall even further over that time, leaving you paying more than you otherwise would have”.

After all, of the five MPC members, two voted for an interest rate cut last week. (The rest voted to keep it unchanged.)

“On balance, this suggests a continued downside bias to the near-term interest rate outlook,” Bravo Finance says in a report, noting that this clashes with the Reserve Bank’s owned model, which projects a hiking cycle commencing in the second half of 2021.

The bank expects inflation to head higher (to 4%) this year – but this is still within its target range.

Bravo Finance believes there is room for interest rates to move lower, as the economic recovery loses steam with South Africa’s return to an adjusted level 3 of lockdown.